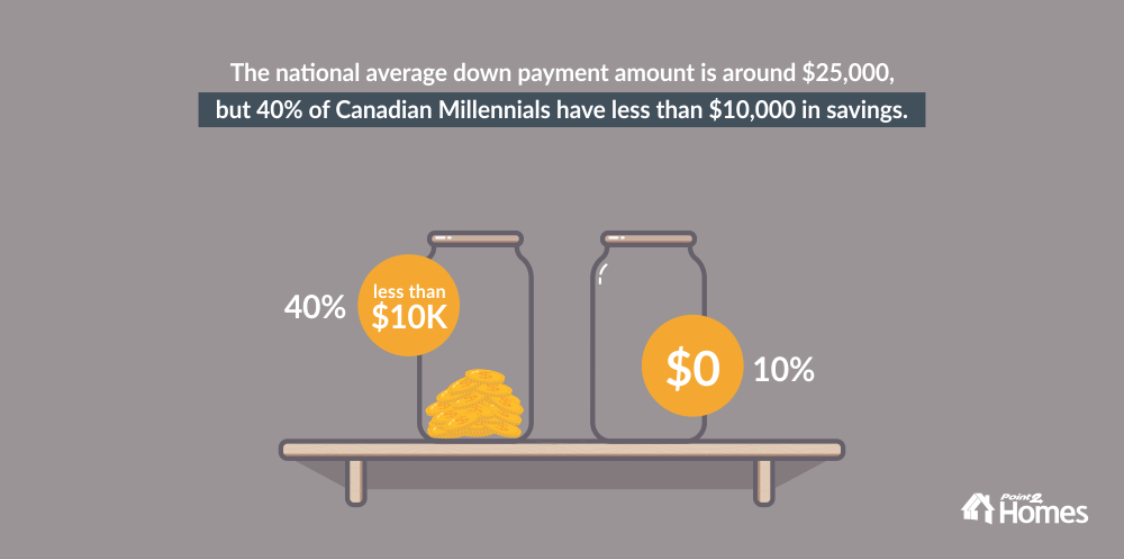

A recent survey by Point2Homes found that while 66 per cent of millennials had an interest in buying a home, half had savings significantly below the national average down payment ($25,000) and 12 per cent didn’t have anything aside. What’s more, 70 per cent of millennials believed that for a down payment they would need less than $50,000 when, in reality, the average down payment is a little over $62,000 in Toronto.

How much do you actually need?

Saving for a down payment is no easy task. For a home that’s $500,000 or less, the down payment must be at least 5 per cent of the purchase price; for a property between $500,000 and $999,999, the down payment must be at least 5 per cent of the first $500,000 ($25,000) plus 10 per cent of the portion of the purchase price over $500,000; and for a property over $1 million, the down payment must be at least 20 per cent of the purchase price.

If you’re self-employed or have a poor credit history, however, a larger down payment may be required. Overall, the bigger the down payment, the better. A bigger down payment decreases the overall debt you have from your mortgage.

Mortgage loan insurance, also known as mortgage default insurance, is something to keep in mind when saving. This insurance protects the mortgage lender in case the borrower is unable to further commit to payments and is mandatory for anyone with less than a 20 per cent down payment. Mortgage loan insurance can be expensive and range between 0.6 per cent and 4.5 per cent of the total mortgage. Where the insurance premium lands depends on the size of your down payment.

While you can get away with a 5 per cent down payment (depending on price), many still opt to save at least 20 per cent to avoid the expensive mortgage default insurance and to reduce the overall debt they’ll have to take on with a new home.

Survey results by Point2Homes

Tips to save for your down payment

If you plan to buy a $400,000 property and want to avoid mortgage default insurance, your downpayment is going to be at least $80,000. Though this seems like an huge number (and it is), it’s not unattainable, especially if you’re planning to buy this home with a significant other. Here are some tips on just how you can save for the down payment.

Taking advantage of financial products — TFSAs, RRSPs, and credit cards

Many financial services can help you save for a down payment, the most obvious being a bank account. Most online banking services allow customers to set up automatic direct deposits into a savings account. So every time a paycheque comes in, your online banking can put away an amount to another account that you’ve committed to not spending. To really boost your savings, commit any pay raises to this savings account and only live off your original salary.

A Tax-Free Savings Account (TFSA) can be the ideal place to store your savings. With a TFSA, any money contributed or earned through the account is tax-free, even when withdrawn. Contributions to this account are ignored on your income tax, and income generated by the TFSA (though stocks, bonds, or funds) is also tax-free.

Canada also has the Home Buyers’ Plan (HBP) to help Canadians with their down payments. The HBP allows you to withdraw up to $25,000 from your Registered Retirement Savings Plan (RRSP) to buy or build a home. This loan has to be repaid within 15 years or else it can result in a massive tax expense. Before using the HBP, you should consider whether you can realistically pay back the amount within 15 years and how taking out this sum will affect your retirement savings goals.

The HBP gave us just the capital we needed to make a 20 per cent down payment on our new condo,

said Sarah Blakes (age 26). She and her fiancé, Arnold Davis (age 27), recently moved into a new condo in the Downtown Core:

Since Arnold and I are far off from retirement, we don’t see borrowing from our RRSP as hurting our future significantly.

One of the most popular banking product is the good ol’ fashion credit card. If you have outstanding credit card debts, it can hinder your ability to borrow more money— i.e., a mortgage. Additionally, when there are numerous credit card interest payments to make every month, it can be hard to save. If this is your situation, the first thing to do is to consolidate your debt. Find the credit card with the lowest interest rate and move your balances from other credit cards to the lowest interest one. Then, pay off the credit card debt as fast as possible to increase your mortgage eligibility and to increase your monthly savings.

25 Scrivener | Toronto Central

Reducing your expenses

Reducing wasteful spending is key to saving, and the first step to this is to create a budget. Every month, examine where most of your money is going to and what can be cut out. Costs like buying lunch can be replaced by meal prepping.

Sarah shares her experience:

Date nights used to always involve dining at nice restaurants downtown. To save for the down payment, Arnold and I opted to buying some nicer ingredients and cooking at home.

There are also other, less common ways to save, as well, such as reducing vacations or selling your car.

Holding back on a trip to Europe or Asia for a year or two won’t kill you and it helps in the long term. Instead, go somewhere cheaper like New York City. You can easily save $500+ just on airfare alone by opting to go south of the border instead of flying overseas. You can even make it a road trip.

One of the biggest expenses you may have is your car. Even if you bought a cheap pre-owned vehicle, simply owning a car costs you expenses in gas, maintenance, insurance, and repairs. If you’re living with your significant other and you both own cars, trying getting rid of at least one car. The sale of the car can provide fresh capital or eliminate expensive monthly car payments that can easily go over $3,000 a year. Depending on the drivers, getting rid of a car insurance can also save $1,000 a year.

Finally, not having to fill the tank or go to a garage can easily result in over $2,500 in annual savings. This amounts to an addition $6,500 of savings per year! Of course, you’ll likely have to supplement this with a TTC pass and a few uber ride, but you’ll likely still come out with extra money in the savings account.

Lastly, the best way to reduce expenses is to not initiate them in the first place. Having a cat or dog can seem fun, but every visit to the veterinarian can cost $300 or possibly more. Then there’s also the amount you’ll have to pay for food, pet toys, and grooming. And renting a place, while saving for a downpayment, can also be an expense you don’t need. This can be renting a place with more space than needed or renting when you could just live with your parents instead.

Getting help from your parents and your in-laws

Help from your parents or in-laws is a popular way to save for a down payment. With real estate prices so high, it’s not uncommon for young, first-time home buyers to ask their parents for either a gift or loan of money. On the flip side, high real estate prices can also mean that parents can more easily borrow against their property to help with their child’s down payment.

Additionally, arranging with your parents to pay a token rent instead of taking on the full cost of Toronto rent prices can help save a lot of money. Even a 200-square foot apartment will cost $1,400 a month. So if you pay a token rent of $500 a month, that means saving $900/month. This was one step Blakes took with her fiancé before buying their condo:

I was fortunate to have parents who let my at-the-time boyfriend and now fiancé and I live with them in Mississauga for a while. Avoiding thousands in monthly rent really helped us save for our condo.

Saving is not easy. Due to the high price of real estate, Torontonians are getting more creative in how they make that downpayment—some even purchasing a property with one or more friends. However, if you can find help from your bank and parents and know where to cut your expenses, you’re already on the right track to becoming a home owner.