Buying a home in Toronto is expensive, and for many young first-time buyers, finding an affordable home may even seem impossible these days. With this in mind, the federal government recently launched the First-Time Home Buyer Incentive (FTHBI) on September 2, 2019. This article will explain the details of the FTHBI, look at the advantages and disadvantages, and whether or not it’s a good choice for you.

READ: Who is the the Toronto Millennial Buyer?

What is the FTHBI and how does it work?

Basically, if you are a first-time home buyer in Canada, and your down payment is less than 20 per cent of the home’s price, the federal government will pay either 5 per cent or 10 per cent of the price with the goal of lowering your monthly mortgage payment. Unlike borrowing from a bank, you don’t need to pay interest on the FTHBI, nor do you need to make ongoing payments.

In terms of how much the Incentive is, that depends on if you’re buying a re-sale home or a new construction. For re-sale homes, the government will contribute 5 per cent of the home purchase price. For a new construction, the government will contribute 5 per cent or 10 per cent of the home purchase price.

If you use the Incentive program, you need to pay it back to the federal government within 25 years or at the time you sell the property, whichever happens first. You can also pay back the Incentive early without any penalty.

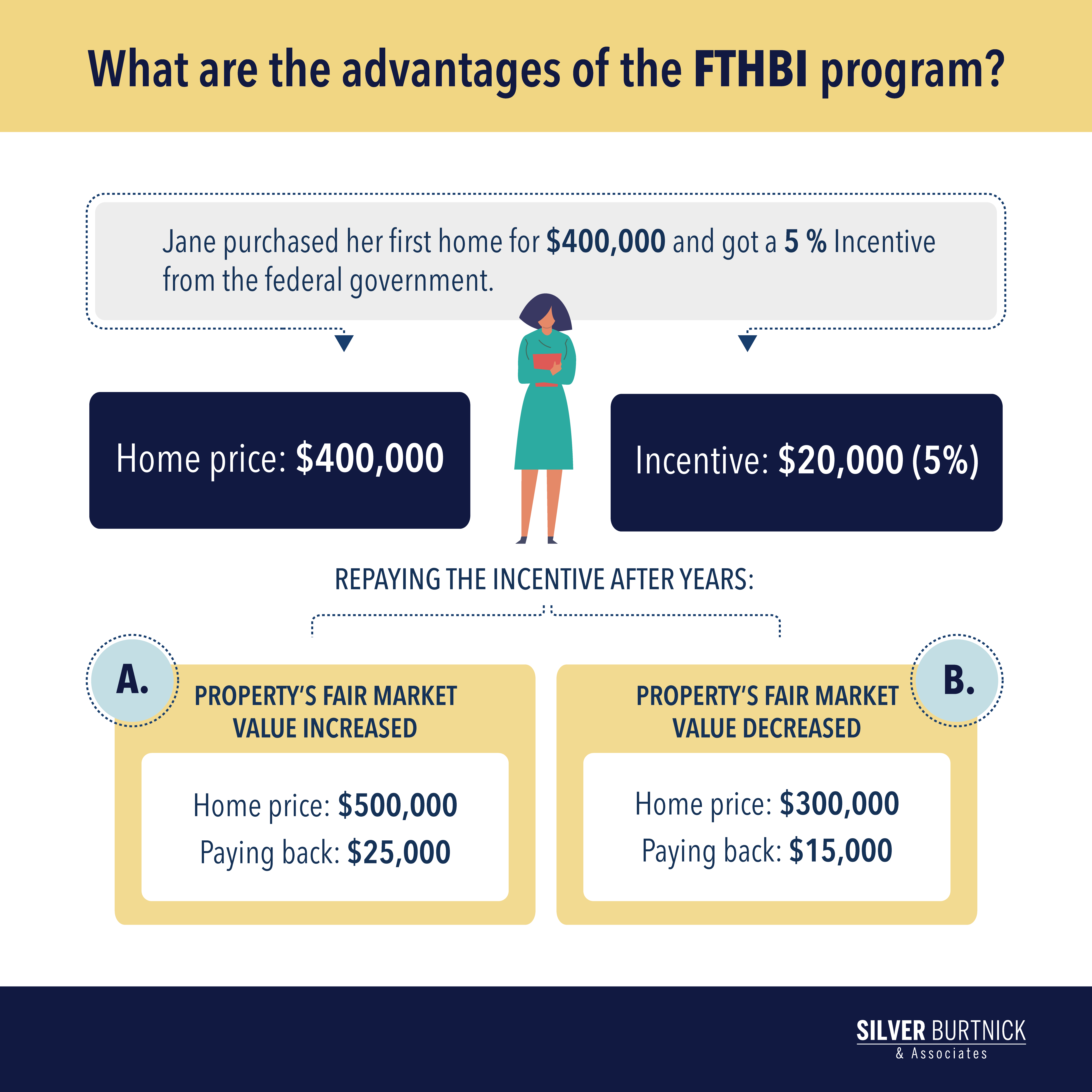

A key characteristic of the FTHBI is that the amount you pay back is based on the market value of your home at the time you pay it back, not at the time you bought it. So if your property rises in value, you pay the government more than what they gave you. If your property drops in value, you pay the government less than what they gave you.

For example, let’s say Jane purchased her first home for $400,000 and got a 5 per cent Incentive from the federal government. The Incentive amount she gets is $20,000 at the time of purchase. Years later, Jane wants to repay the Incentive to the federal government. Now, her property’s fair market value increased to $500,000, so she needs to pay back $25,000. If instead, the property’s value dropped to $300,000, then Jane would need to pay back $15,000.

What are the requirements to use the FTHBI?

Not all first-time home buyers qualify. In addition to being a first-time home buyer, you need to meet these conditions:

- You need to have the minimum down payment for the property you want to buy*

- Your maximum qualifying income** is $120,000

- Your total borrowing from all sources is no more than 4 times your qualifying income

- You also need to be a Canadian citizen, permanent resident, or a non-permanent resident who is legally allowed to work in Canada

- You are buying this first home for the purpose of living there, not as an investment property.

*The minimum down payment you need to have is 5 per cent for the first $500,000 of a home’s price, and then 10 per cent for any more over $500,000. For example, if the home’s price is $600,000, you need a down payment of $25,000 + $10,000 = $35,000.

**Your qualifying income includes your annual salary (before taxes), investment income, and rental income. If you are applying for the Incentive with a partner, you have to add your qualifying incomes together and make sure it’s $120,000 or less.

READ: Shopping for Mortgages -Millennials vs Baby Boomers

What are the advantages of the FTHBI program?

If you are a first-time home buyer with a qualifying income of less than $120,000 this program can be a big help.

Let’s say you want to buy a $400,000 condo in Toronto. You need to save at minimum 5 per cent ($20,000) regardless of whether you apply for the FTHBI. After you’ve saved 5 per cent, the FTHBI can give you another 5 per cent ($20,000). That will reduce your monthly mortgage from $2,964 to $2,736. Over a year, that’s almost $3,000 in savings! Furthermore, you can wait up to 25 years in the future to pay back the Incentive amount without worrying about paying interest.

For most people, as they get older, their financial situation improves. So when you do need to pay back the FTHBI in the future, you should be at a much better financial position to do so. However, if you are able to pay back sooner, you should take advantage of the fact that there is no penalty for earlier repayment and get out of that debt before you decide to make any renovations and increase the value of the property.

What are the disadvantages of the FTHBI program?

Arguably the biggest disadvantage of the FTHBI program is that it’s not very helpful to people in expensive housing markets like Toronto and Vancouver. Because of this drawback, a CBC opinions article declared the FTHBI to be of “limited value”.

Since your maximum borrowing is limited to four times your qualifying income, the maximum house price you can get in this program is 4 times your qualifying income plus whatever amount you’ve saved up. On the other hand, if you don’t use the FTHBI, you can afford a house price that is 20 times whatever amount you’ve saved up.

For example, let’s say your qualifying income is $100,000 and you saved $25,000. Without the FTHBI, you could buy a home that’s $500,000 using the $25,000 as a 5 per cent down payment and then borrowing the rest from the bank. But with the FTHBI, you can only borrow $400,000 maximum, limiting the purchasing price of your home to $425,000.

According to RBC’s June 2019 Housing Affordability Report, the average house price in Toronto was about $1 million, and the average condo price was about $538,000. That means houses most likely won’t qualify for the FTHBI, but some condos may qualify.

The thing with markets like Toronto and Vancouver though is that we expect property prices to continue rising, so if you do happen to use the FTHBI to get a condo, you’ll probably be paying more back to the government in the future.

Should I apply for the FTHBI?

If you are looking for a detached home in the Greater Toronto Area, the prices will be too high to qualify for the FTHBI. But if you are interested in a condo, the price may qualify. In that case, the FTHBI can help you reduce your monthly mortgage payments. However, you should keep in mind that the condo prices will keep on rising in Toronto and you will have to pay back more than you borrowed.

Celia Alves, a Sales Representative from Sotheby’s International Realty Canada, comments:

The program Is essentially a shared equity program – where the Canada Mortgage and Housing Corporation (CMHC) contributes part of the down payment in exchange for sharing in the appreciation of the property when you sell the home. But with a maximum purchase price of $565,000 it won’t be life changing for buyers in the Toronto market today.