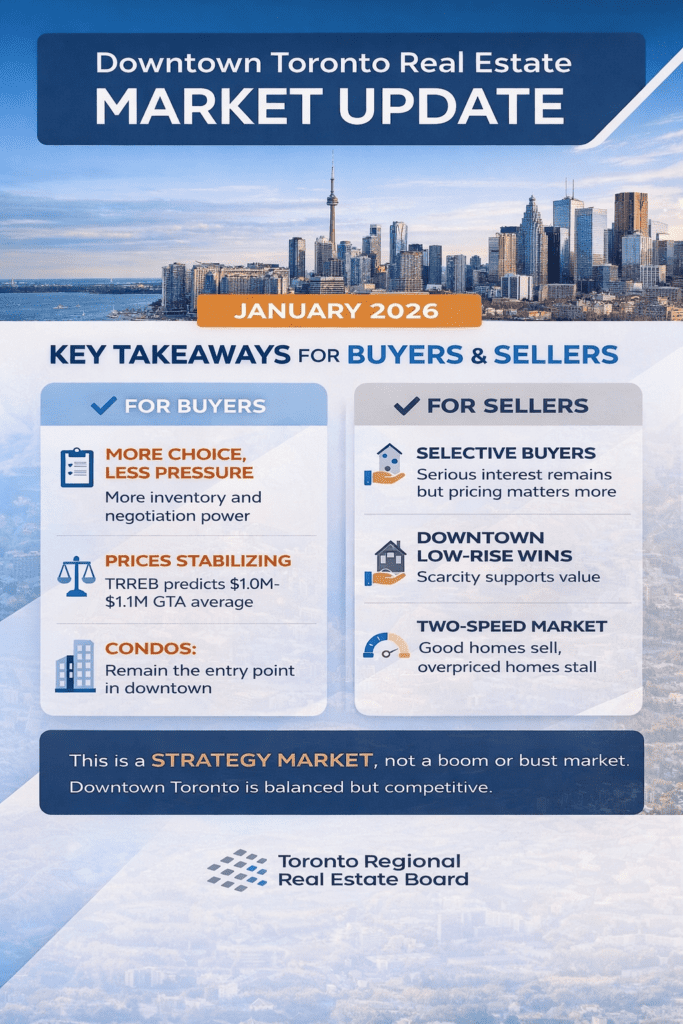

In March 2020, the Bank of Canada (BOC) shrunk their target interest rate in an attempt to mitigate economic damage brought on by the COVID-19 pandemic. Today, in an effort to curb inflation, these rates are back on the rise.

Earlier this year the BOC’s target interest rate grew from 0.25% to 0.50%. Not long after in April, the target rate grew another 50 basis points reaching 1.0%. As new rates bring higher costs to financial institutions, these increases will in turn impact anyone looking to get a mortgage.

Along with the hikes in target interest rates, the government recently announced a series of new initiatives designed to cool the housing market and make more inventory available for Canadians. So how exactly will these changes affect home buyers?

As always, seeking out expert advice is the best approach for navigating the home buying process. We spoke with Michael Oziel from Sherwood Mortgage Group about how these new changes may impact buyers.

Buying as a downsizer? Download our complete guide to rightsizing.

How Are These Hikes Impacting Buyers Today?

“The biggest change we’ve seen in buyers as a result of these interest rate increases is morale,” explains Michael. Over the past two years, buyers have become accustomed to extremely low rates, so these increases seem more drastic than they really are. Yet, many buyers have become discouraged. Michael notes, “In reality, interest rates are essentially back to where they were before the pandemic. So while yes, mortgages will be more costly now compared to this time last year, they’re still at a relatively low rate and quite affordable.

If these new rates don’t make a big difference for buyers, what’s with all the fuss? Michael explains, “Ultimately, any kind of change in the economy will inevitably cause panic. When Canadians see these kinds of announcements on the news it can create unnecessary panic.

In the grand scheme of things, interest rates are still low and the recent hikes will only mean a small change in your mortgage payments long term.

Considering a move? Check out these resources from our blog.

- Why Right Now is the Best Time to Sell Your Home

- Should You Wait to Sell Your Home After COVID-19?

- Why You Should Never Skip Out on Staging

What Should Current Homeowners Know?

Like buyers, these new interest rates won’t have a large impact on existing homeowners. That said, if your mortgage is up for refinancing soon you will see a small increase in your monthly payments. Essentially, for every quarter-point climb in your rate, your monthly mortgage costs will increase by just $11 for every $100K owed according to Michael.

If you’re planning on moving soon, know that you have options. Mortgages are portable, meaning you can transfer them to your new home. However, some buyers prefer to break their mortgage and start fresh.

Variable vs Fixed?

When you apply for a mortgage, you’ll have the option to select either a fixed or variable rate. As the name suggests, a variable rate mortgage means your interest costs will fluctuate based on the market. These days, variable rate mortgages are almost always the best option for buyers.

According to Michael, of all the mortgages currently held in Canada, about 70% are variable. Trends are showing that this number is likely to increase over time – and for good reason. “Right now, the difference between variable and fixed rates is 1.5% – that’s a long runway,” says Michael. He continues, “If you look at the big picture, you’ll typically pay less over the term of the mortgage if you choose a variable rate.”

So what about the other 30%? Michael explains, “When we look at the much higher interest rate environment in the 80s, it can appear that locking into a fixed rate is a low-risk way to quickly pay off your mortgage. In reality, when we consider market trends and factors, variable rates are still the best route for new homeowners looking to pay less”.

Michael also points out, “If you are to break your mortgage, you could face a higher penalty with a fixed rate. Another great reason to opt for a variable.”

Getting ready to buy your first home? Explore these resources to help make it a great success.

- What to do if Your Pre-construction Condo is Delayed

- A Condo Buying Guide For Millenials

- How to Realistically Save For a Downpayment in Toronto

What About The Foreign Buyer’s Ban?

Shortly after the BOC’s initial rate increase, the federal government announced a handful of new initiatives meant to support Canadians throughout the ongoing housing crisis. Among these initiatives is a two-year restriction on any foreign buyers purchasing property in Canada. However, one critical detail is that this ban will only apply to buyers who don’t plan to live on the property.

This small restriction is not likely to noticeably influence housing costs. Michael points out, “Foreign investors were already an insignificant portion of the market.” He continues, “Unfortunately, this small change will do very little to alter housing supply and virtually no one in the industry is expecting this change to impact domestic buyers.”

Looking Ahead

When planning for the future, buyers and homeowners can rely on relatively consistent market conditions. Economists predict the BOC will make one more increase to the target rate this year, then remain steady for a while.

If you have concerns about financial planning or whether or not you can afford a home in today’s market, talk to an expert. A mortgage broker can offer an honest analysis of your finances and let you know what the best path will be for you. You can also work with your real estate agent to find a great home that meets your needs and budget.

Have questions for a mortgage broker? Contact Michael or learn more about Sherwood Mortgage Group here.

Ready to begin your home buying journey? Get in touch with us.